Research Tools Grade: C

Overview:

The research tools available at eOption are comparable to the average broker offering. Company specific information available includes accounting forms, company filings and insider activity. The stock and mutual fund screeners and calendars are useful but both are fairly standard broker offerings. Options specific educational tools are very basic and could use some advanced features.

Details:

To access the eOption research tools, navigate to the Research tab or the Tools tab from within the eOption website.

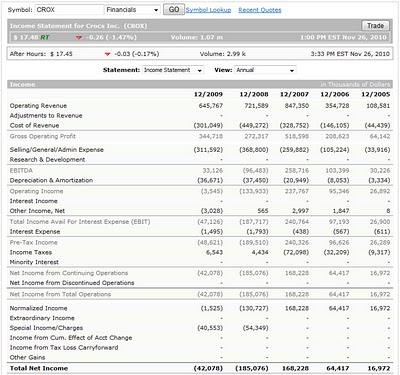

Company profile pages are available that show very basic company descriptions. More useful are the company financial pages, which contain the basic accounting forms (balance sheet, income statement and statement of cash flows). Here is a view of the income statement for Crocs (CROX), the maker of those horrible plastic shoes (click on images for larger views):

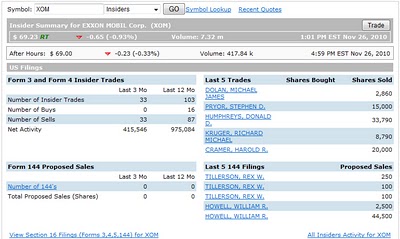

Other company specific sections include filings, such as annual reports and quarterly statements, and insider activity. Here is a view of the insider summary page for Exxon Mobil:

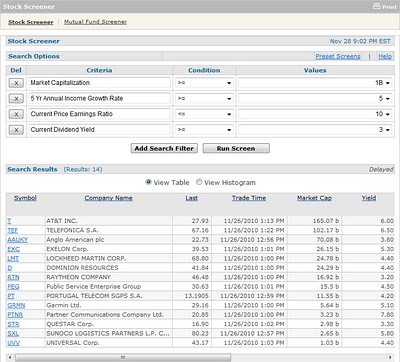

eOption has both a stock and a mutual fund screener. The stock screener is pretty good thanks to an extensive 67 screening criteria but the value ranges for criteria could be handled a little better. For example, users can screen against a price/earnings ratio of 5, 10 or 15 but cannot customize the value to something more specific like 9.5 or 12.2. Here is a screening we ran for stocks based on market capitalization, income growth rate, price/earnings ratio and dividend yield:

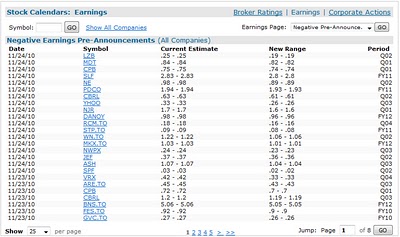

The stock calendar is divided into thee separate sections: analyst upgrades/downgrades, earnings estimates and corporate actions (splits/dividends). The earnings calendar in particular is well done, with five different earnings related announcement types from which to choose. Here is a look at recent negative earnings pre-announcements:

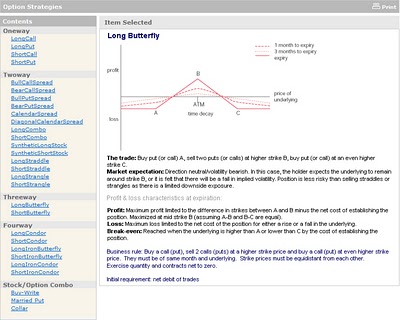

The option strategies section provides a brief overview of some popular option strategies such as straddles and iron condors. Here is a view of the page describing the long butterfly strategy:

The options strategies pages are very superficial and we would hope that nobody would trade on the information therein alone. To go one step further, eOption offers more detailed pages called option classes that cover everything from the basics of buying puts and calls to betting on volatility or using market neutral strategies. These are not true classes, however, and are really just introductory tutorials. With eOption's obvious focus on options trading we were hoping for some more advanced options trading tools but we were sadly disappointed.

Related Articles:

eOption Review

eOption Stock Trading

eOption Options Trading

eOption Charts