Options Trading Grade: A

Note: This is our review of the standard web based optionsXpress options trading platform. For our review of the optionsXpress Xtend options trading platform click here.

Overview:

As one would expect from its name alone, optionsXpress offers an impressive options trading platform. Initiating orders from the trade ticket could use a slight redesign with how it interacts with the options chain menu. New in 2011 is the all-in-one trade ticket, which is a huge improvement for those that trade advanced order types. The new trade ticket also handles additional advanced order types that were not previously present in the older menus. Closing out existing holdings from the positions menu works perfectly as does modifying and canceling open orders. Option contract price charts are available but are not very well designed while trade confirmations include execution time down the second. With the addition of the new all-in-one trade ticket, optionsXpress now receives our highest grade for its powerful web based options trading platform.

Option Order Types:

- Buy Call / Put (one option leg) - Buy a single call/put

- Covered Call (stock + one option leg) - Buy stock and sell call option

- Married Put (stock + one option leg) - Buy stock and buy put option

- Collar (stock + two option legs) - Either (1) Buy a put option, sell a call option and short the corresponding stock or (2) sell a call, buy a put and buy the corresponding stock

- Spread (two option legs) - An order to simultaneously purchase and sell options at different strike prices, where both have the same underlying, right (call or put) and expiration date

- Combo (two option legs) - Either (1) buy a put option and sell a call option or (2) sell a call and buy a put

- Straddle (two option legs) - Buy / sell a put and call with matching strikes and expiration

- Strangle (two option legs) - Buy / sell a put and call with matching strikes and varying expiration

- Calendar (two option legs) - Buy / sell a pair of puts or a pair of calls with varying expirations

- Diagonal (two option legs) - Buy / sell a pair of puts or a pair of calls with varying strikes and expirations

- Butterfly (three option legs) - Buy an option with one strike price, buy an option with a second strike price, and sell two options with a third strike price that is midway between the prices of the first two options

- Condor (four option legs) - Buy two options and sell two options. All options are either puts or calls.

- Iron Condor (four option legs) - Buy / sell two puts and buy / sell two calls

- One Cancels Other aka OCO (two option legs) - When one order is filled the other order is simultaneously cancelled (when both orders are linked with OCO). Used primarily as an exit strategy, customers use the OCO feature to assist in either capturing gains or avoiding losses.

- Contingent (one option leg) - Customizable order type that can trigger based on specific price, time or volume conditions. These are often referred to as conditional trades.

Details:

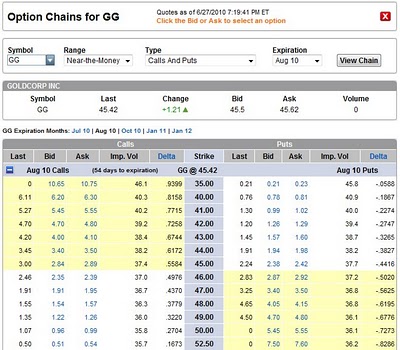

To trade options at optionsXpress, select the top menu item Trade and then select Options, which brings up the trade ticket. Advanced order types have their own separate menus but for our purposes here we will execute a single leg order from the basic options trading menu. We first entered the underlying stock symbol for Goldcorp (GG) which by default loaded the cheapest in the money call. This was not the contract we were after so we then clicked on the Find Chain link. We changed the selection to show August 2010 put and call contracts that were near the money (click on images for larger views):

When we found a contract that interested us, we wished to find out more contract details. This could only be done by closing the trade ticket options chain and accessing the more detailed options chain from the main menu. This second options chain menu featured a link to the detailed options contract page. It would be more convenient if the first options chain menu also had this link.

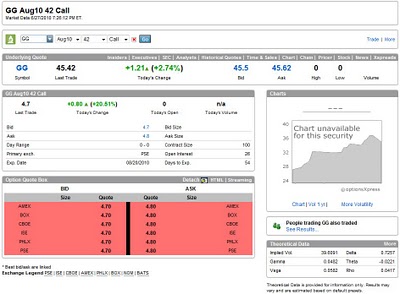

The detailed options contract pages contain daily pricing details, implied volatility, financial Greeks and price, volume and volatility charts. In the example below, it says that the price chart is not available but it does actually load a large if rudimentary chart:

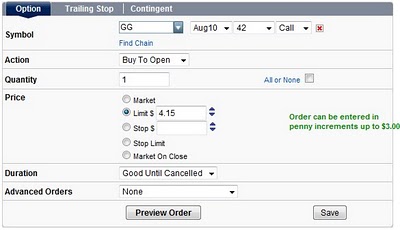

We decided to trade this option so we clicked on the Trade link. This loaded the trade ticket with our desired contract automatically populated. We changed the action to Buy, the quantity to 1 contract, the limit price of $4.15 and a duration of good until canceled. OptionsXpress does not provide an expiration date for good until canceled orders:

As an alternative to the options order entry menu, the All-In-One Trade Ticket made its debut in April 2011. Users enter a symbol and then select to trade either stocks, options or futures. For options, order types range from simple puts and calls to advanced orders such as butterflies and condors. We think this menu is a great improvement over the old menu structure, especially for advanced options traders. Here is an Iron Condor order that we entered for Apple (AAPL):

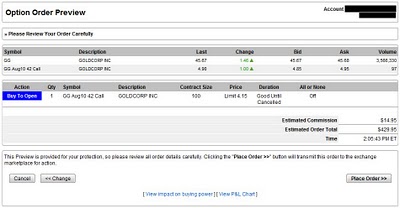

Switching back to our original options order, we arrived at the order preview screen, which showed the previously entered trade information, an estimated commission and estimated total cost for the trade. Everything looked OK so we clicked the Place Order button:

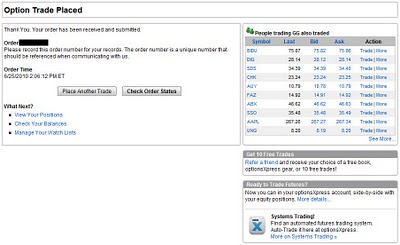

Our order was submitted successfully so we were presented with an order number, a list of stocks traded by people who also traded Goldcorp shares and links to place additional trades or to check the status of our newly submitted trade:

We clicked on the second link which brought up the trade status menu. From this screen open orders can be modified or canceled, with both actions working as expected.

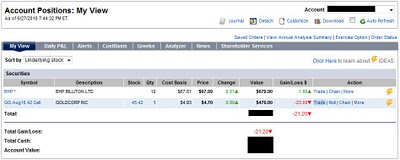

Once our trade executed it was instantly loaded into our account positions view. We decided to close out our holding so we clicked on the Trade link next to our position:

This brought up the trade ticket with the symbol, action and number of shares auto populated. We changed the order type to limit, entered a limit price and then selected to submit our order the same way as before.

Related Articles:

optionsXpress Review

optionsXpress Stock Trading

optionsXpress Charts

optionsXpress Research Tools

optionsXpress iPhone App

optionsXpress Android App