Options Trading Grade: F

Overview:

Options trading at ShareBuilder is poorly implemented. The only advanced order types available focus solely on covered calls. Trade confirmations include the date of transactions but do not show the hour or minute of execution. Open orders can be canceled but they cannot be modified. Our biggest concern is that there are issues with submitting limit orders under specific circumstances, which we cover in detail below. In the end, we cannot recommend ShareBuilder as an options trading platform.

Option Order Types:

- Buy Call / Put (one option leg) - Buy a single call / put

- Covered Call (one option leg) - Write a call against an already held stock position

- Buy / Write (one option leg + stock) - Simultaneously purchase stock and sell a call option of the same underlying security

- Unwind (one option leg + stock) - Close out an existing covered position (sell both the stock shares and the option contracts)

Details:

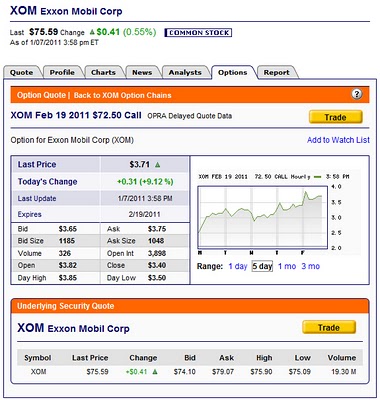

To trade options at ShareBuilder select Trade, Options Trading and then Buy / Sell Options from the top menu. This will load the options trade ticket. Next, click on the Find Option link which will load a new window. We typed in XOM (Exxon Mobil) and selected the View button to load the options chains. ShareBuilder has highly useful option contract quote pages but strangely enough these pages cannot be accessed from within this menu. We closed this window and navigated to the quote page, which shows pricing information and an options price chart. From here we clicked on the Trade button (click on images for larger views):

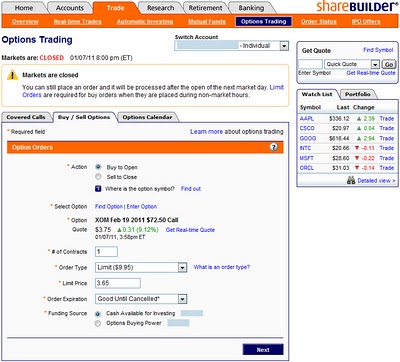

This loaded the trade ticket with the contract populated. We then selected to buy 1 contract at a limit price of $3.65 and an expiration designation of good until cancelled, which are purged after 60 days:

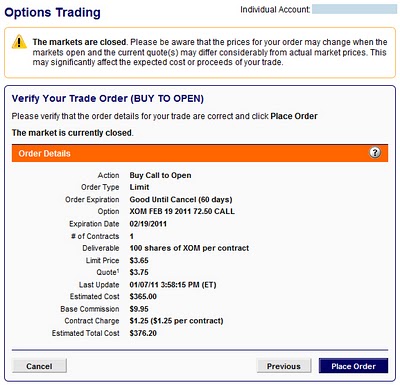

The next menu showed our order summary, with the total estimated cost including commissions. Everything looked correct so we clicked on the Place Order button:

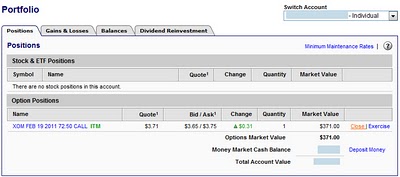

Our order was submitted successfully and we were prompted with a link to access the order status menu. From here, open orders can be canceled but they cannot be modified, a feature found at many other brokers. Once orders execute then current positions will appear in the Account Portfolio menu:

Positions can be closed out from this menu by clicking on the Close link. This will load the options trade ticket with the action set to sell, the contract set to the existing position and an order type of market. The number of contracts can be typed into the provided text box or users can select the check box to sell all contracts.

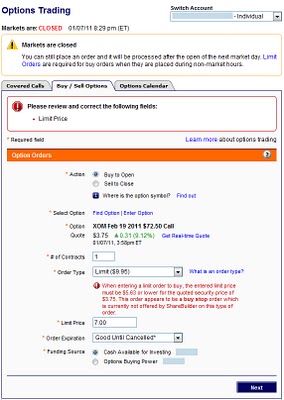

When submitting a different options order we received the following error message:

The error message states as follows:

When entering a limit order to buy, the entered limit price must be $5.63 or lower for the quoted security price of $3.75. This order appears to be a buy stop order which is currently not offered by ShareBuilder on this type of order.

It appears that limit prices can only be submitted if they are no more than 50% above the last trade price. A simple warning message would suffice but there is no way to ignore this message and we either have to enter a new limit price or cancel the order. Since this order is being submitted outside of market hours, we might happen to know that trading will open significantly higher than the closing price from the previous day. ShareBuilder assumes we don't know what we are doing and blocks our order. This is totally unacceptable and renders ShareBuilder unusable as an options trading platform.

Related Articles:

ShareBuilder Review

ShareBuilder Stock Trading

ShareBuilder Charts

ShareBuilder Research Tools

ShareBuilder iPhone App