Power E*TRADE Pro Options Trading Grade: B

To get free trades, free cash and other great deals

visit our Discounts and Special Offers page

visit our Discounts and Special Offers page

Note: This is our review of options trading in Power E*TRADE Pro. For our review of options trading in the standard web based E*TRADE click here.

Overview:

Power E*TRADE Pro is a respectable options trading platform. Opening new positions from the order entry window works as expected, though closing out holdings from the positions menu could be handled a lot better. Modifying and canceling orders from the order status window works flawlessly. Trade confirmations include transaction time down to the second. Many of the major options order types are here but for an active trader platform, we expected to see a few more. Issues aside, Power E*TRADE Pro is an improvement of the web based E*TRADE options trading platform and is a solid choice for most traders.

Order Types:

- Basic (one option leg) - Buy or sell a single put or call

- Covereds (stock + one option leg) - Buy / sell stock and buy / sell a put / call

- Spreads (two option legs) - An order to simultaneously purchase and sell options at different strike prices, where both have the same underlying, right (call or put) and expiration date

- Butterfly (three option legs) - Buy an option with one strike price, buy an option with a second strike price, and sell two options with a third strike price that is midway between the prices of the first two options

- Iron Butterfly (four option legs) - Differs from the butterfly spread because it uses both calls and puts, as opposed to all calls or all puts.

- Condor (four option legs) - Buy two options and sell two options. All options are either puts or calls.

- Iron Condor (four option legs) - Buy / sell two puts and buy/sell two calls

Details:

Power E*TRADE Pro is a Java application that is launched from the E*TRADE website. The platform is geared towards active traders and is free for all E*TRADE customers that execute 30 or more stock or option trades per calendar quarter. We called E*TRADE and they granted us access to use Power E*TRADE Pro free for one calendar quarter. All E*TRADE customers should be eligible for this offer. Make sure to request access early in the calendar quarter to get the longest trial period possible.

The Power E*TRADE Pro Interface

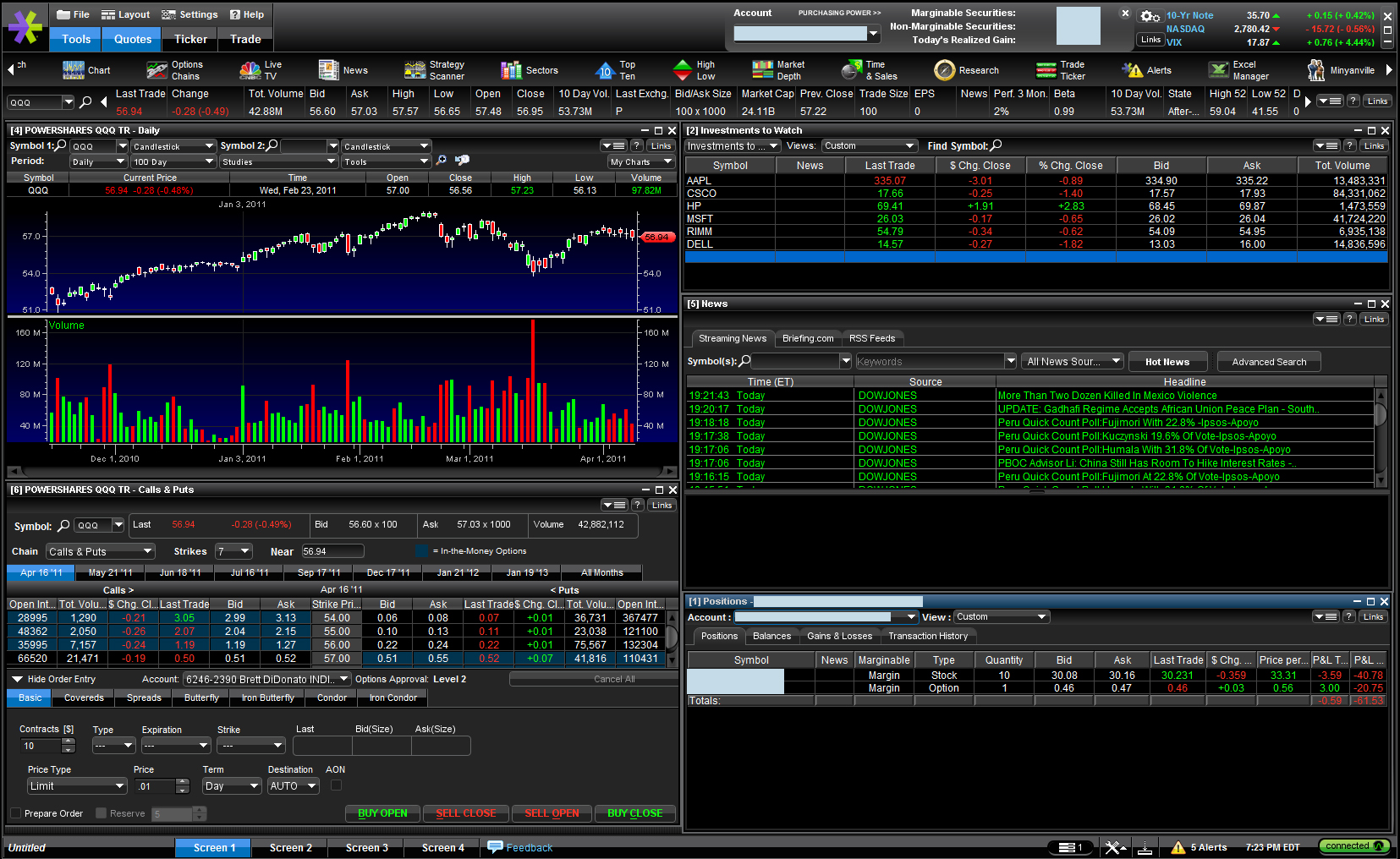

The Power E*TRADE Pro platform consists of a top menu, the main window and a bottom menu. The top left menu contains selections for switching layouts, changing application settings, accessing help menus and changing accounts. The top right has quotes for the major market indexes. Just below this are buttons to toggle additional menus for tools, quotes, a scrolling ticker and the trade ticket. The tools menu contains icons for windows such as watch lists, charts, options chains and news. The main window displays menus organized in any layout that the user desires. Individual windows can be placed and resized as users see fit. Users can also select from a series of predefined layouts. Finally, the bottom menu contains buttons to toggle between four layouts, tool links, quick access to the order entry window and quick access to alerts ans.

Here is a look at the interface with the charts, options chains, watch lists, news and positions windows open and sized to our liking (click on images for larger views):

Options Trading

To trade options within Power E*TRADE Pro, select Order Entry from the top menu to load the options order entry window. We selected to buy 1 May 2011 Citigroup Put with a limit price of $0.50 and a term of good until canceled (GTC). GTC orders are maintained in E*TRADE's system for 60 calendar days until they are purged. Once everything was set we clicked on the BUY OPEN button:

This loaded a separate window with an order summary. With other orders we submitted, we were prompted with a warning message notifying us that our limit price was at least 20% above the current ask price. This is just a warning message though and can simply be ignored. Back to our previous trade, we next clicked the Place Trade button:

Our order was submitted but no confirmation message was generated. This is the only instance we can think of where a trading platform of any type did not provided a confirmation message was an order was submitted. Nevertheless, we switched over to the Order Status window. This window can be filtered by account, order status and symbol. Orders can be both modified and canceled from here, with both actions functioning flawlessly.

We allowed our order to execute and once it did we checked on the status from the Positions window. This window can be fully customized, with over 100 columns to choose from that can be displayed in various fonts and colors. We decided to sell so we right clicked on our position and selected Place Trade.

As expected, this loaded the Order Entry window but the quantity defaulted to 10 contracts and not the number of contracts in our portfolio. It is a minor oversight but is something that is handled well by many competing trading platforms.

Related Articles:

E*TRADE Review

E*TRADE Stock Trading

E*TRADE Options Trading

E*TRADE Research Tools

E*TRADE iPhone App

E*TRADE iPad App

E*TRADE Android App